Indonesia is emerging as a significant market, driven by a global economic shift towards innovation and knowledge-based economies. The Directorate General of Intellectual Property (DGIP) in Indonesia is actively transforming its approach to Intellectual Property (IP), moving beyond mere legal protection to making IP an instrument for converting knowledge, works, and innovations into economic value. This proactive stance positions Indonesia as an increasingly attractive destination for foreign brands, where robust IP protection is not just a legal formality but a strategic asset for growth.

Indonesia: A Burgeoning Market Opportunity

Indonesia is positioning itself as a high-growth market, underpinned by innovation, creativity, and technology. Key indicators highlight why foreign brands should pay close attention:

- Rising Innovation Capacity

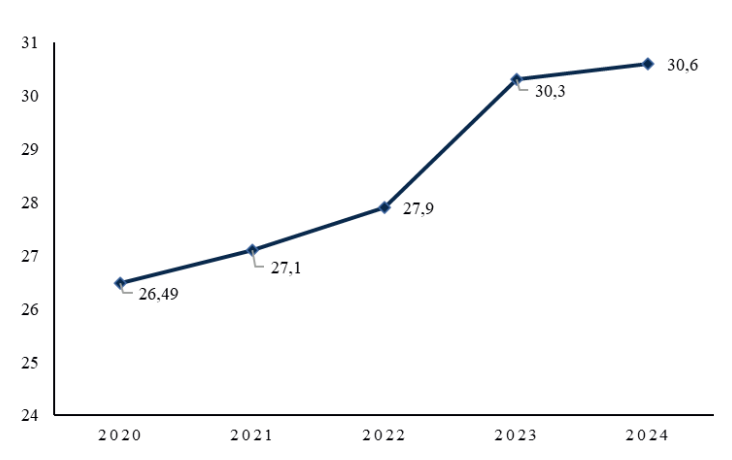

Indonesia advanced in the Global Innovation Index (GII) from rank 75 (score 27.9) in 2022 to 54 in 2024 (score 30.6), reflecting a stronger national innovation infrastructure.

Source: DGIP Whitepaper IP Outlook 2025

- Creative Economy Expansion

Projected to contribute over Rp1.5 trillion to GDP in 2024 and employing 26.5 million people, the creative economy (culinary, fashion, film, music, apps, handicrafts) is a core driver of growth and heavily reliant on IP protection.

- Domestic IP Growth

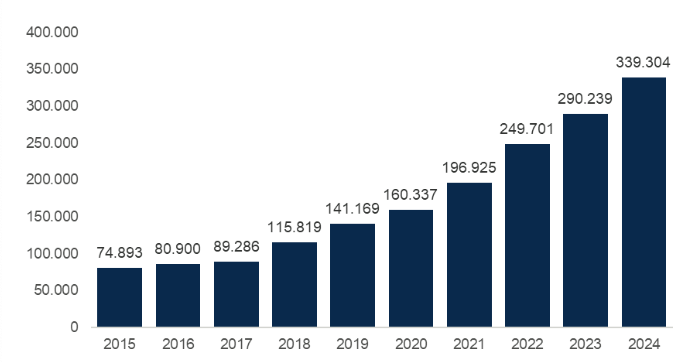

IP applications rose from 74,893 in 2015 to 339,304 in 2024, averaging 18.5% annual growth—signaling rising awareness of brand and innovation protection.

Source: DGIP Whitepaper IP Outlook 2025

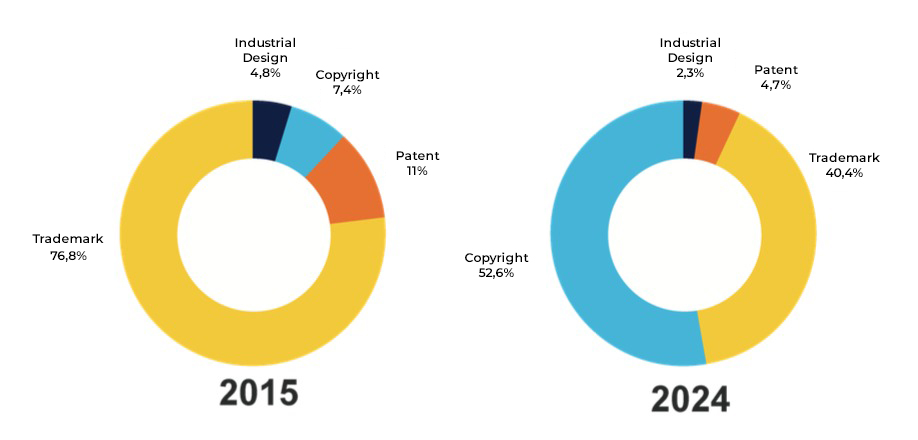

- Composition of IP Applications by Type

The comparison between 2015 and 2024 shows a significant shift in the composition of IP applications in Indonesia. In 2015, Trademarks dominated with 76.8%, while Copyright (7.4%), Patents (11%), and Industrial Designs (4.8%) accounted for relatively smaller shares. By 2024, however, Copyright had surged dramatically to 52.6%, becoming the largest category, while Trademarks dropped to 40.4%. Patent applications also declined to 4.7%, and Industrial Designs fell to just 2.3%. This indicates a significant shift from Trademark-heavy filings toward Copyright-focused protection, reflecting changes in the creative and digital industries over the past decade. - Percentage of IP Applications by Origin, in total since 2015:

Domestic 86.7% VS Global 13,2%

- Total Copyright & Trademark Applications since 2015

Source: DGIP Whitepaper IP Outlook 2025

- Total Patent & Industrial Design Application since 2015

Source: DGIP Whitepaper IP Outlook 2025

- SMEs as Key Contributors

SMEs accounted for 86.76% of IP applications between 2015 and 2024. Leading sectors include food & beverages and cosmetics, both increasingly active on digital platforms, highlighting the urgency of brand differentiation.

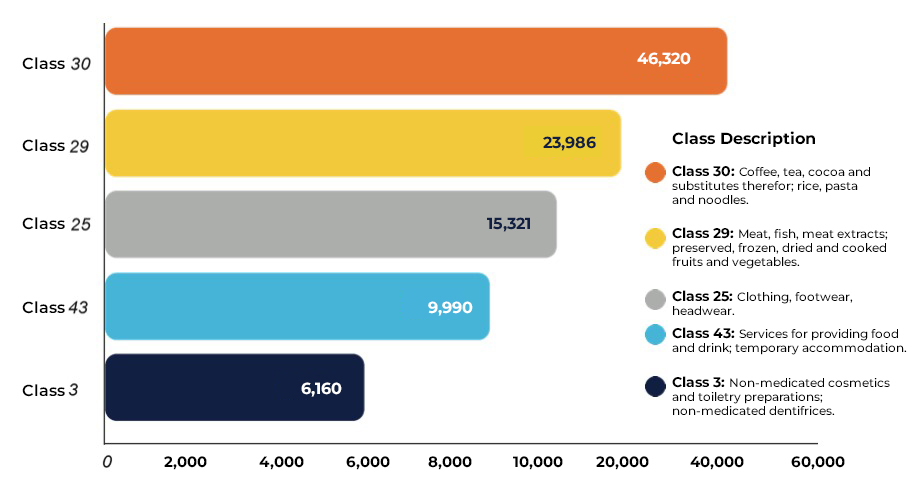

- Top 5 Trademark Application from SMEs by Class

Source: DGIP Whitepaper IP Outlook 2025

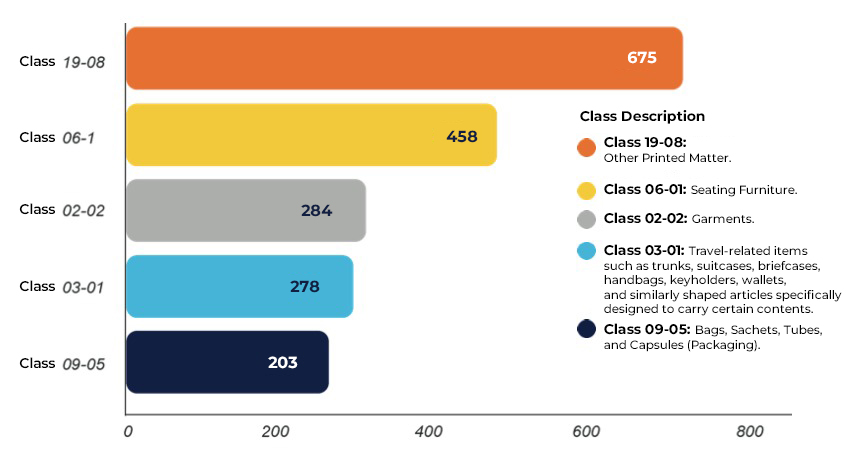

- Top 5 Industrial Design Application from SMEs by Class

Source: DGIP Whitepaper IP Outlook 2025

- Industrial Innovation

The chemical, pharmaceutical, and traditional medicine sectors are driving Patent filings, underscoring strong R&D activity and sector-specific opportunities.

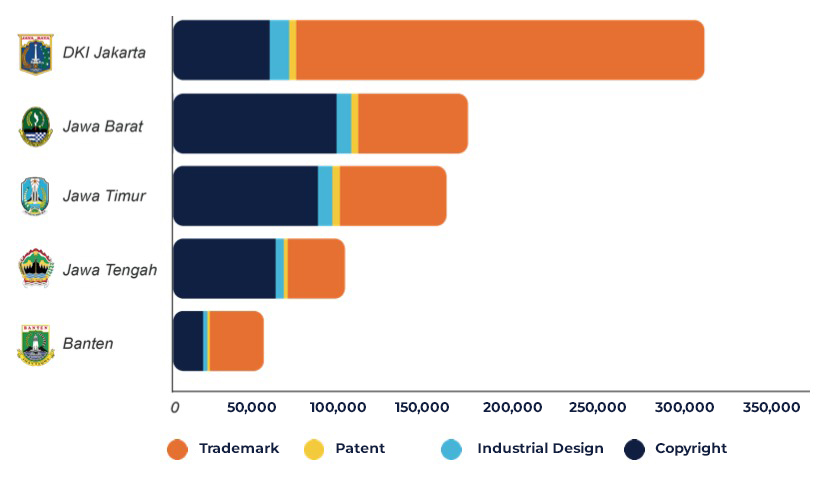

- Geographic Concentration

DKI Jakarta, West Java, East Java, Central Java, and Banten dominate IP registrations. Jakarta leads as the national hub, with dense manufacturing, SMEs, and startups fueling market activity.

Source: DGIP Whitepaper IP Outlook 2025

Protecting Your Growth: The Crucial Role of IP

For foreign brands entering Indonesia, a strong IP strategy is no longer optional—it is fundamental. The country is reshaping its IP ecosystem to create a safer, more predictable environment for innovation and investment.

- Transforming the IP Paradigm

The Directorate General of Intellectual Property (DGIP) now positions IP as a strategic intangible asset that drives investment. Beyond mere registration certificates, the focus has expanded to valuation, monetisation, and commercialisation—embedding IP directly into Indonesia’s knowledge-based economy.

- Digital Transformation of Services

Indonesia has modernised its IP infrastructure through digital platforms such as e-Hak Cipta (2015), SIMPONI payment integration (2017), and the all-encompassing IPROLINE system (2019). These advancements provide faster, more transparent, and user-friendly services for both domestic and foreign applicants.

- IP as Collateral for Financing

A landmark reform allows IP certificates to be used as collateral for credit, especially empowering SMEs. Supported by credible valuation standards and financial sector alignment, this initiative unlocks real economic value from intangible assets—attracting investors and venture capital.

- International IP Facilitation

Since joining the Madrid Protocol in 2018, Indonesia has streamlined global Trademark registration, enabling foreign brands to secure protection in multiple markets via a single application. The country is also welcoming more foreign Geographical Indications, underscoring reciprocal trust in its IP system.

- Policy and Legislative Modernisation

Indonesia is reinforcing its IP landscape through continuous policy updates and legislative reforms, providing greater legal certainty for innovators and investors.

- Thematic Years of IP

To spotlight different areas of IP, DGIP has designated specific “Thematic Years,” such as Geographical Indications (2018, 2024), Industrial Design (2019), Patents (2021), Copyright (2022), and Trademarks (2023). Notably, the One Village One Brand (OVOB) program under Trademarks promotes collective brand registration for local products, reflecting the government’s commitment to translating IP into real economic value.

- Copyright Law Revision

A revision of Law No. 28 of 2014 on Copyright is currently underway as part of the National Legislation Program. The update aims to keep pace with digital transformation, particularly in expanding protection for creative works within online and technological ecosystems.

- Addressing IP Infringement:

While Indonesia faces challenges such as rampant IP infringement in the digital era, particularly concerning Trademarks (148 reported cases from 2019-2024) and Copyrights, the government is committed to strengthening enforcement. Strategic recommendations include:- Effective Legal Protection:

Reforming the IP enforcement system to be faster and more effective, focusing on accelerating new regulations and strengthening public complaint mechanisms for digital infringements. - Inter-Sectoral Coordination:

Adopting models from countries like the USA (Digital Millennium Copyright Act – DMCA), South Korea (IP Protection Center), and the EU (Observatory on IP Infringements) to create a coordinated mechanism between DJKI, Kominfo, law enforcement, and digital platforms to enforce content removal. - AI and IP:

Acknowledging the challenge of IP protection for AI-generated works, the government is preparing revisions to the Copyright Law to address the rapidly evolving digital technology landscape.

- Effective Legal Protection:

Conclusion

Indonesia’s dynamic economy, coupled with a strong and evolving IP protection framework, presents a compelling market for foreign brands. The government’s proactive approach to transforming IP into an economic driver, its commitment to digitalising services, facilitating IP-backed financing, and modernising legislation, creates a more secure environment for investment. While challenges like infringement exist, the ongoing efforts to strengthen enforcement mechanisms indicate a clear direction towards a robust and reliable IP ecosystem. For foreign brands, understanding and leveraging Indonesia’s intellectual property framework will be crucial for sustainable growth and competitive advantage in this promising market.

Need help protecting your IP in Indonesia? Book a free 15-minute consultation with one of our professional IP consultants:

? E-Mail : [email protected]

? Book a Call : +62 21 83793812

? WhatsApp : +62 812 87000 889

Source:

- Whitepaper IP Outlook 2025